2ND ADDRESS

Connecting Hosts & Guests for Extended Stays into Furnished Homes

2ND ADDRESS

Connecting Hosts & Guests for Extended Stays into Furnished Homes

ZENTLY

Transforming Rental Living & Property Management

2ND ADDRESS

Connecting Hosts & Guests for Extended Stays into Furnished Homes

Make voice - video calls and send SMS through any devices

Make voice - video calls and send SMS through any devices

Make voice - video calls and send SMS through any devices

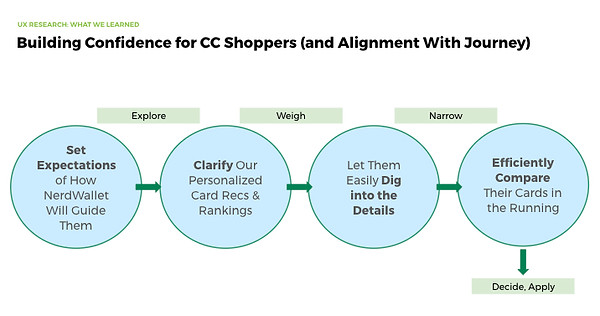

Your Personalized Financial Match Journey

Helping people find financial products just for them and manage finances.

MATCH SCORE

Project Overview

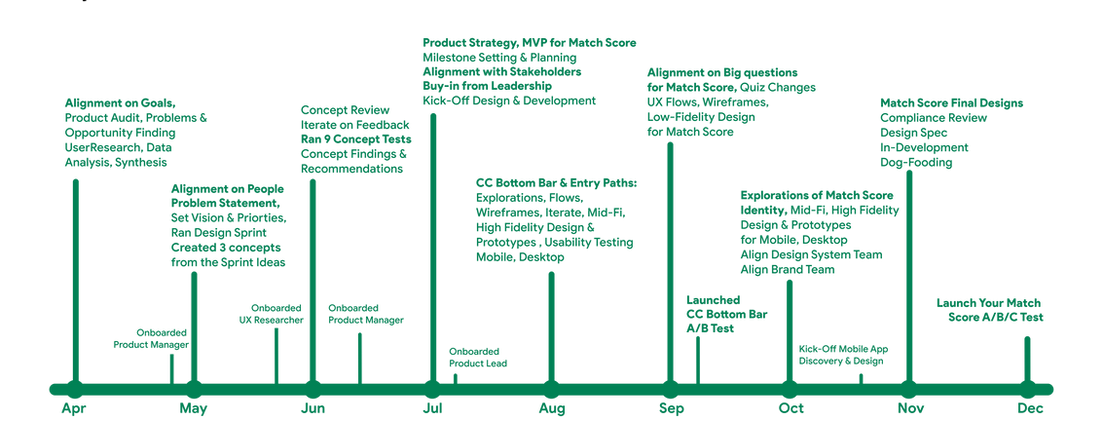

When I joined NerdWallet, this project had been hanging for 6 months with lot of ambiguity There were many challenges with reorgs and for our team alone we had four Product Managers within span of 6 months. But the goal was ambitious.

We had business defined goal to increase the conversion within the Credit Card marketplace yet the users pain points, their needs were not defined. We had no vision and product strategy of how we will achieve this.

MY ROLE

I lead the entire process from discovery to launch 🚀by aligning the team towards a shared goal of solving for users, finding user insights through research, finding product issues by running an audit and there after running a design sprint to solve for users. We came up with many concepts and I came up with innovative concept of "Match Score". I aligned the team to this idea through validated concept testing. We then embarked on the journey to design, develop and launch this project. We also worked on creating a bottom navigation that streamlines the users journey, making way-finding and discoverability easier.

We have started launching this starting with the Credit Card Marketplace Experience in phases and conceptualized it as to how it will layer up it with Membership experience; Personal Finance Dashboard & Feed, Credit Score, Rewards, Spending, Play your Cards Right since the recommendations are based on these factors and provide a great place to give guidance to users, recommending them financial products which will provide them more value.

MY ROLE

Product Lead Designer

TEAM/STAKEHOLDERS

Product Manager: 4 changes

UX Researcher: Joined Mid-way

Content Strategist

4 Engineers

Data Analyst

Platform + Design System Team

Compliance: Legal & Partners

SPECIALITIES

Vision & Product Strategy,

Thought Leadership

Influence & Alignment

Scoping and Roadmap

UX Design, UI Design

Visual Design

UX Research

YEAR

2019

MATCH SCORE

Project Timeline

THE CHALLENGE

Business defined goal

Credit Card is the most mature market in the NerdWallet ecosystem and most of the revenue comes from there. The vertical already has tons of monetizing pages - the Best Credit Card Page, RoundUp Pages, Review Pages, Filter Pages, Side-by-side Comparison Pages, Personalized Recommendation Pages other than the blog pages. We also have a tons of other features which gives users ability to check approval Odds or check which cards they can pre-qualify to. Yet with all these pages we were getting very low conversion for the users who visit our marketplace.

Our goal was create an experience that increases the conversion.

We had a user insight that Credit Card shopping process is scattered and time-consuming for low-intent users. Based on that, the team had a hypothesis that if we create a streamlined journey of credit card shopping process for the users it will guide them, see more users return and apply at NerdWallet. It was a belief that in all likelihood this will increase the conversion, increase retention, engagement and activation into membership.

With that our challenge to design a journey that guides users in Credit Card shopping process.

We didn't know what the journey entailed. We already had enough products within Credit Card Marketplace

CC Portal Page

BCC Page

Filter Pages

Credit Card Detail

RoundUps

Side-by-Side Comparison

Blog, Review Pages

DISCOVERED USER DATA STORY

Digging Deeper and Becoming User-Focussed.

NerdWallet Credit Marketplace gets about 15 million visitors per month from which 10% visitors are on Credit Card marketplace and blogs. From that only 3% users convert and we were not sure why users don't apply for Credit Cards at NerdWallet, when they have come looking for it.

We also had only 3% of those users activating their Transunion to get their Credit Score and check Approval odds when they apply to the credit card while we only had 3% users going through the personalized recommendation flow. From all the visitors we had only 15% users return at NerdWallet within 6 months, so there was hardly any retention. The cohort who use the personal finance management app were totally separate cohort and only make .7% of users from total NerdWallet visitors. We were essentially losing significant users who could potentially be our long term customers.

With all that understanding of data we aligned on three-fold business goal with the main goal being conversion. We needed to find user driven goals for each metric so I started to loosely define them:

-

Conversion: Help users get what they are looking for in such a way that they feel guided and there by take action with confidence.

-

Activation & Retention: Show visitors value in more than what they are looking for at NerdWallet so that they sign up and return back to NerdWallet.

-

Engagement & Retention: Give more insights and actions to the NerdWallet members and possibly recommend financial products which will help them reach their goals faster.

Our challenge was to find deeper user insights and ideas itself that could help inform product strategy and further design an experience that give users guidance and confidence to apply for credit cards at NerdWallet.

How do we give users guidance and confidence?

My early assumptions and user research helped us land on these key user insights.

-

Simplify to appropriate choices: People want fewer choices rather than being overwhelmed by many choices as anyways finances are overwhelming.

-

Personalizing the experience: People want recommendations based on individual's financial circumstances and profile rather than advice that is broad and generalist.

-

Build Trust: People want to know recommendations they receive are unbiased, and truly in their best interest. They want assurance and credibility.

-

Show them the process & details with clarity: People want to objectively know what makes the recommendations and if all factors have been covered. They still want to dig into details

-

Empower them to take well-informed decisions: People can't be forced to take action.

Based on these insights we generated 3 Solution Ideas.

Checklist

Let process be your guide

Provides the big picture of the credit card shopping journey through a step-by-step process.

#teachmehowtofish

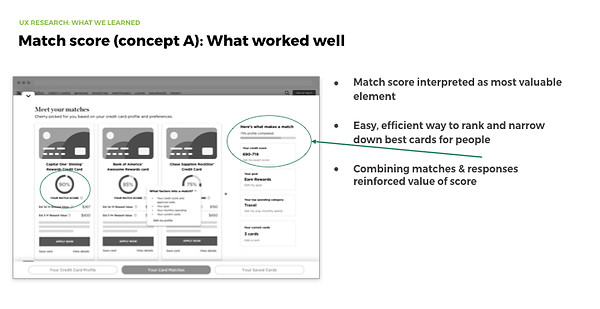

Match Score

Let numbers guide you

Numbers that tells user how best a card matches to their financial profile and preferences.

#math#datascience#personalization

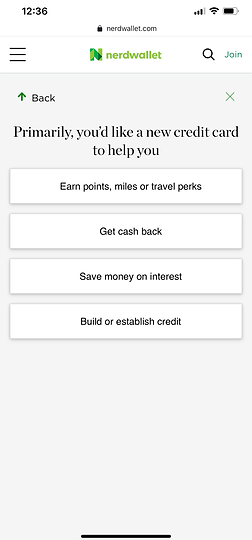

Nerdy Guidance

Let nerds be your guide

Strategically placed personalized nudges that prompts the users to “Turn to the Nerds” to get the right card.

#friendinthecorner

We concept tested these ideas and found Match Score to be most valuable concept for users. It elevated their confidence, showed them the process, helped them build trust and gave them a personalized experience. From there we embarked on the journey to define scope, plan the milestones to this project, design and develop it.

THE SOLUTION

Introducing Your Match Journey

Personalizing the financial marketplace experience.

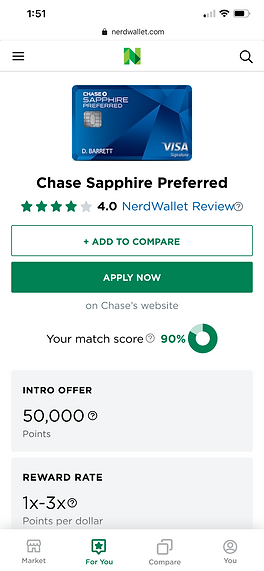

Number, a percentage that tells the user how best a card matches to their financial profile & preferences.

Match Score is calculated through 4 factors:

-

Goals & preferences: Cash back, Rewards, Travel

-

Spending habits: Maximizing Rewards

-

Cards in their Wallet: Pairing

-

Credit Score: Approval Odds

We believe Match Score placed along side cards would help users decide on card confidently and give users a personalized experience, along with that increase activation to become NW members and retention of NW visitors and members.

#empower users#datascience#nerdalert

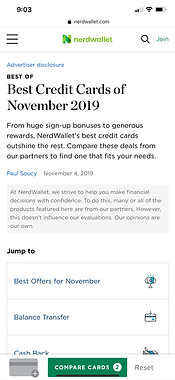

THE OTHER HALF OF SOLUTION

The Entry Paths - Easier way to way-finding and discovering more.

We also redesigned part of the navigation and repurposed the Credit Card Bottom bar into a navigation hub: a place for users to easily get to primary destinations and continue their journey easily: be able to quickly find "matches for you", be able to easily find a place of their saved cards to compare and get to the personal dashboard where they can see more value of being a NerdWallet member. This was our vision and we are launching this in phases.

We kicked off a redesign of whole navigation based on this vision.

Show the meal, not the menu!

THE RESULT & IMPACT

We launched a part of this bottom navigation on Credit Cards with For you and Compare and saw

80%

lift in the users who discovered the personalized recommendation flow. These two are the most converting pages on the Credit Card marketplace Experience.

Control

Variant

DESIGN PROCESS

Let's dive into how we got there!

We approached the problem with human-centered design process

DISCOVERY

Empathize with Users, Understand Business, Competition

DEFINE

Reframing the Problem,

Deep insights & Prioritize

IDEATE

Crazy 8's , Solutions Sketches.

App Architecture

PROTOTYPE

User Flows, Wireframes,

Prototype, Mocks

TEST

Observe Users,

Get Feedback & Iterate

Further Case study in Works to Polish! Be happy to Browse.

SET THE STAGE

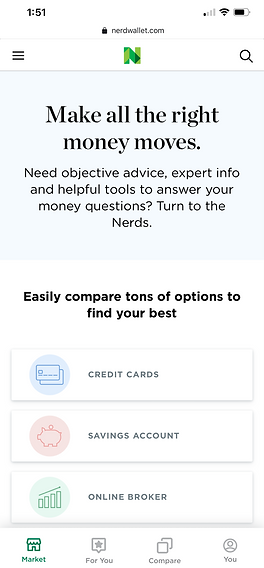

Understand NerdWallet Ecosystem

At it’s core, NerdWallet is a content company. Their mission is to provide clarity for all of life’s financial decisions. NerdWallet does this really well by providing unbiased and in-depth information, financial advice and education as well as access to free financial calculators and simulators. Nerdwallet has developed marketplace experiences that not only help people understand their options, but provide tools to make decisions and take steps towards improving their financial health. In 2009, NerdWallet started by helping consumers figure out which credit cards are right for them, and since then NerdWallet has replicated their SEO strategy to expand beyond credit cards to offer financial clarity across banking, personal loans, home mortgages, insurance, and investing.

DISCOVERY

Evolved, SEO-driven company into a Product Company

NerdWallet does SEO really well. But the challenge is this: not many users know NerdWallet by itself not they many know of the Personal Finance Management App . With over 1700+ SEO optimized articles and content pages covering most financial topics, the current experience is still a rather shallow one that goes something like this: type in any financial question in Google, for example “which credit card has the best airline miles program?” then land on a NerdWallet article, and use the free advice and tools before proceeding to a financial partner’s site to get a better product. Once people have their answer, they leave NerdWallet and rarely come back. NerdWallet’s current product strategy introduced the following challenges:

-

Shallow experience. NerdWallet isn’t seen as a product company. It’s not a product people have a relationship with; they have a relationship with Google. It’s Google they trust and use to help them find content on NerdWallet.

-

Isolated experience. Once people visit NerdWallet, it isn’t clear to them that NerdWallet offers advice and services across the entire financial landscape, and goes beyond just the specific financial question they have asked. They don't know about the membership mobile app experience which helps them stay on top of their finances.

NerdWallet Marketplace Experience

for different Verticals

NerdWallet mWeb Member

Experience to stay on top of finances

NerdWallet mobile app experience to stay

of top of your finances.

DISCOVERY

Finding Gaps in our current Credit Card Marketplace

I started with auditing what are the issues in our current experience and why do users not be able to discover these features as well as why users who visit don't go from one page to another. The problem lied in the information architecture and how navigation was built around it making it difficult for users to discover destinations.

DISCOVERY

But what about the consumer pain points?

In addition to the product challenges for NerdWallet, key consumer pain points from our research formed the basis for our work. We learned that...

-

Finances are overwhelming. It’s not something people enjoy thinking or learning about; and when they start, people don’t know where to begin. Challenges such as paying off large debt amounts, or figuring out how to plan for retirement are big hurdles to tackle.

-

People don’t trust financial institutions. It isn’t always clear to consumers if the advice and recommendations they receive are unbiased, and truly in their best interests.

-

The experience isn’t personalized. NerdWallet’s advice is written for broad audience segments and may or may not be applicable to the specific nuances of an individual's financial circumstances and profile.

-

People don’t know what they don’t know. Financial knowledge doesn’t come easy. Finances are complicated, and often people don't know where to learn more, what questions to ask, or if they are making the right financial decisions. For example, someone with a low credit score might not know how to improve their score, while another person with a similarly low score not even know that their credit score is something to be concerned about. In other words, people don’t know what they don’t know.

-

Taking action isn’t easy. Once people have the right insights, it isn’t always clear what the next step is, or how to take the next step.

DISCOVERY

What was NerdWallet doing to address it?

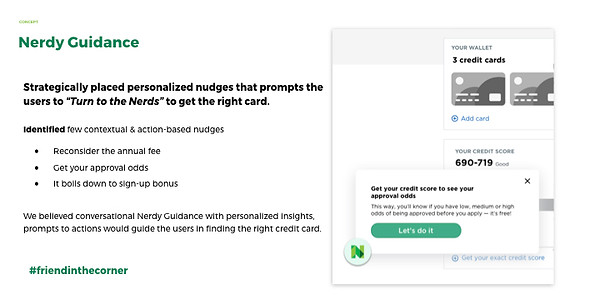

Within Credit Cards Marketplace we also had a personalized recommendation flow but users were not even aware of it and neither were they returning or becoming power NerdWallet users. I started investigating the reason for it.

In fact Personalized Recommendation Converts as well! But we don’t get enough traffic there.

The personalized recommendation flow has a net conversion of 3.8% - much greater than other CC shopping UX’s, yet only 5% of CC traffic (-37,750 of 750,000) goes to personalization recommendation flow.

Completion Rate : 48 % completes the flow.

Personalized Recommendation Flow

for Credit Cards In Marketplace Exp.

Personalized Recommendation Flow

for Credit Cards In Marketplace Exp.

Personalized Recommendation Flow

for Credit Cards In Marketplace Exp.

DEFINE

How might we?

With all that understanding and empathy that we developed, understood product challenges and ec0-system, vision and priority set with our main goal being guiding and making users confident to apply for Credit Card, our success metric being conversion, we now needed to get into the ideation process. Developing HMW statements really helped us focus through our brainstorming ideation session.

-

HMW show users where they are in the process and make it easier for them to do the next thing to get the CC of their choice?

-

HMW proactively narrow results based on user's information? HMW we build trust, personalization, clarity through the process?

-

HMW encourage users to make sure of their decisions by using NerdWallet?

-

HMW provide incentives for people to apply at NerdWallet at not somewhere else?

We also set some principles so we stay focussed as the earlier design sprint session had generated ideas which weren't feasible or viable to execute at the pace we wanted.

-

Don’t need to be exhaustive: Keep it Simple. Decrease annoyance, confusion anxiety and doubt, increase confidence for them to take empowered well-informed decisions.

-

Don’t need to reinvent the wheel. Find starting points within our current experience to redesign, build on or optimize.

-

Be more proactive in prompting users to complete steps & move along the journey.

-

Use Design, Copy & Content to help consumer focuses on most important things

IDEATION

Brainstorm Session with Crazy 8's Solution Sketch

We ran a design sprint/brainstorming session after we had uncovered the deep insights and decided which ones tackle. .We landed with three key concepts after dot voting and lot of "Thinking Hat" method.

Checklist

Let the process be your guide

Provides the big picture of the credit card shopping journey through a step-by-step process.

#teachmehowtofish

Match Score

Let numbers guide you

Numbers that tells user how best a card matches to their financial profile and preferences.

#math#datascience#personalization

Nerdy Guidance

Let nerds be your guide

Numbers that tells user how best a card matches to their financial profile and preferences.

#math#datascience#personalization

DEFINE

Priortization and MVP Scope

We ran a design sprint/brainstorming session after we had uncovered the deep insights and decided which ones tackle. We created a list of "How might We" statements to run the sprint. we landed with three key concepts after dot voting and lot of "Thinking Hat" method.

We also created a Risk-value matrix to prioritize and decided what areas will we focus for Milesetone 1.

DEFINE

Scope, Key Challenges, UX Risks, Success Metrics

Before we could start designing we had to align on lot of open ended questions. Here are some of them. We also had to define the UX Risks, Design Acceptance Criteria, Success Metrics,.

-

Do we redesign new products Cards? Do we use the bespoke caed or universal card?

-

What makes the Match Score?

-

Unlocking Match score takes user where?

-

What is Match Score? % or out No out of 5

-

Where all it does it live? How does it play with other information?

-

How much real estate does it take?

-

What’s the prioritization of CTA’s on the product card?

-

How are the user flows to get match score for a card vs best matches for them?

-

What are the different states of these?

-

How do we handle approval odds and match score within product card?

-

Will we redesign the quiz flow to create the match score?

-

What will we cannibalize by putting this in production?

-

What will be our guardrail metrics? What pages will we

DESIGN

Determine how we handle approvals odds vs match score

We ran a design sprint/brainstorming session after we had uncovered the deep insights and decided which ones tackle. We created a list of "How might We" statements to run the sprint. we landed with three key concepts after dot voting and lot of "Thinking Hat" method.

DESIGN

Redesign the decision tree for Quiz

We ran a design sprint/brainstorming session after we had uncovered the deep insights and decided which ones tackle. We created a list of "How might We" statements to run the sprint. we landed with three key concepts after dot voting and lot of "Thinking Hat" method.

DESIGN

Where does it sit within existing product card?

We ran a design sprint/brainstorming session after we had uncovered the deep insights and decided which ones tackle. We created a list of "How might We" statements to run the sprint. we landed with three key concepts after dot voting and lot of "Thinking Hat" method.